What is the basis for imposing a windfall tax on PFI operating companies and what sum could be reasonably expected?

The NHS is currently in the most austere decade of funding growth in its 69-year history and is facing an unprecedented funding gap of up to £34bn over the 5-year period to 2020/21.

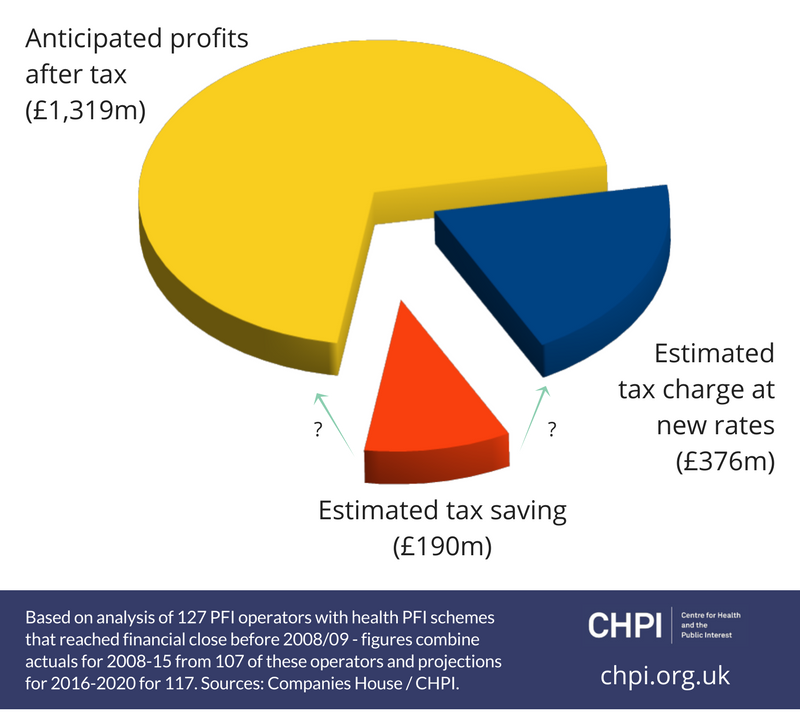

With planners facing the unenviable task of rationing care, questions have been raised about areas of NHS funding where savings could be made without affecting patient care. A recent CHPI report found that over the past 6 years PFI companies made pre-tax profits of £831m and are estimated to make profits of almost £1bn over the next 5 years. This led to calls for a windfall tax to be levied on PFI companies.

In theory a windfall tax could be levied to recoup some of the excess gains made by PFI operating companies (SPVs) with NHS or social care contracts. The tax could be raised from gains arising from the fall in the corporation tax rate from 30% (FY07/08) to 20% (FY15/16), and down to 17% by April 2020.

Modelling PFI contract costs

When PFI deals were designed and negotiated they included an expected rate of return for the investors along with agreed payments over the lifetime of the contract (on average 27 years for health contracts). These contracts offered a relatively

secure rate of return for the PFI investors, many of whom sub-contracted any maintenance work and explicitly removed the financial risks associate with inflation and changes in interest rates.

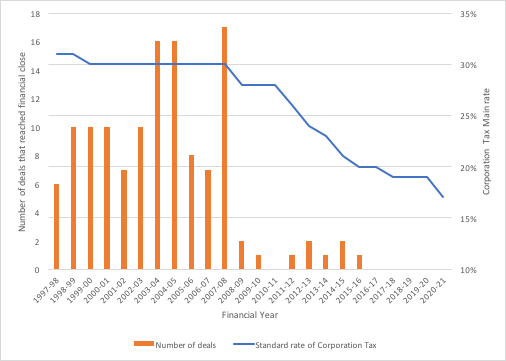

One of the modelled costs in the contract was the expected corporation tax rate that would be paid by the investors. The majority (92%) of NHS and social care PFI contracts were agreed and signed before the reduction in corporation tax (standard) rates in 2008/09 from 30% (see figure 1 below) and so their models reflect this higher rate.

Figure 1: Health PFI deals signed and Corporation Tax rate

Source: HM Treasury. Private Finance Initiative and Private Finance 2 projects: 2016 summary data.((https://www.gov.uk/government/publications/private-finance-initiative-and-private-finance-2-projects-2016-summary-data))

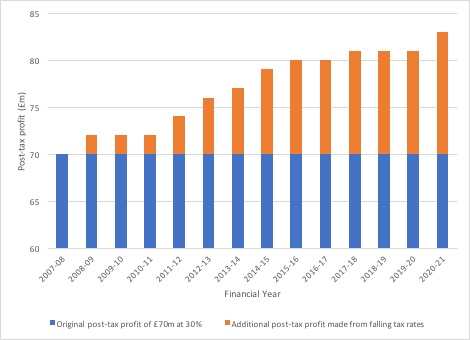

For every £100m of pre-tax profit that is made by PFI operators they will now in 2021 receive £83m of post-tax profit instead of the expected £70m at the original tax rates. This is a huge increase in returns and a windfall.

Figure 2: Increase in post-tax profits from falling Corporation tax rates (for every £100m of pre-tax profit made)

Implication for PFI companies and economic activity

Consecutive falls in corporation tax rates since 2008/09 have provided an additional and unexpected increase in financial returns for PFI operators. Is this an issue?

Cuts to corporation taxes were intended as a means to stimulate growth and increase business investment. However, PFI operating companies have arguably contributed less to the economy and exchequer than they might otherwise have done because they have certain distinctive features compared to typical businesses:

- Ordinarily businesses’ revenues and profits will be generally uncertain each year, however, PFI operators have fixed and agreed revenue and costs over an average period of 3 decades. Any tax cut provides additional financial benefits over what they have already provided for and expected;

- Once construction is complete, the PFI operators have relatively little ongoing extra construction or investment to do, aside from contractually agreed ‘lifecycle’ maintenance and works, so tax cuts tend to stimulate no extra investment in the PFI scheme itself;

- Many of the PFI operating companies are sold on from the original owners to new shareholders who are often institutional investors. These investors are often based offshore and have been found to pay little, if any, tax. Many are pension funds with international investors, so any tax cut for them does not guarantee an increase in business investment in the UK;

- Most PFI operators outsource all maintenance and facilities management to sub-contractors. Any tax cut to the PFI company itself will not incentivise their sub-contractors to provide new investment or a better quality of service.

Given these features, enabling PFI operators to benefit from a lower corporation tax rate seems unnecessarily generous especially when the NHS, and wider public services, are undergoing conditions of austerity. Moreover, levying a windfall tax that recouped the monies saved since 2008/09 wouldn’t distort the economic activity of PFI operators because the long-term contracts they signed anticipated a given rate of return which would have expected the tax savings they have since experienced.

How much have PFI operating companies saved so far?

Without access to each company’s corporation tax return a precise overall figure cannot be supplied. However a good estimate can be made by looking at the corporation tax charge (in their published accounts) in each year from 2008 (when corporation tax rates dropped from 30%) and comparing it to the estimated corporation tax charge if tax rates had stayed at 30%.

Table 1: Tax saving made by the 105 health PFI operators with accounts available that reached financial close before 2008/09 – £000s

| Profits Before Tax (PBT)

2008-2015 |

Actual tax charge per accounts

2008-2015 |

Estimated tax charge (at main rate 30%)

2008-15 |

Estimated tax saving |

| 942,560 | 198,733 | 282,768 | 84,035 |

Source: Review of PFI operators’ accounts available at Companies House

In Table 1, the £84m estimated tax saving represents 9% of Profit Before Tax (PBT) for the period and represents a 42% increase on the actual tax charge.

Future tax savings – a forecast

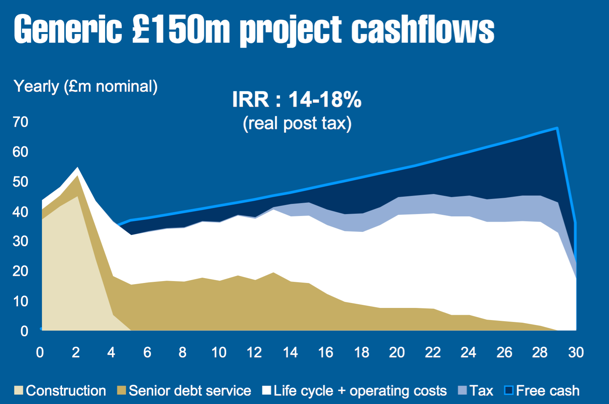

PFI contracts are modelled to make low profits/losses in the early years of the contract (where they pay down their loans to banks and shareholders) and become increasingly profitable in later years, as the example in Figure 3 shows.

Figure 3: Balfour Beatty projection of cash flows from the lifetime of a PFI project

Source: Balfour Beatty, PPP/PFI Seminar. London, June 2003.((https://www.balfourbeatty.com/media/29335/ppp_pfi_2003.pdf))

Using data collected from a previous CHPI paper, and forecasting profits into the future, Table 2 forecasts the future savings made from falling tax rates over the years from 2016 to 2020.

Table 2: Forecast future tax savings made by the 117 PFI operators with health PFI schemes that reached financial close before 2008/09 – £000s

| Profits Before Tax (PBT)

2016-2020 |

Forecast tax charge

2016-2020 |

Estimated tax charge (at main rate 30%)

2016-20 |

Estimated tax saving |

| 942,051 | 176,796 | 282,615 | 105,819 |

Source: Forecast based on trend information from a review of PFI operators’ accounts available at Companies House

The £106m estimated tax saving represents 11% of PBT for the period and is 60% higher than the forecast tax charge at the lower tax rates.

Conclusion

The analysis shows that there is a case for levying a windfall tax on PFI operators in a way that does not impact their expected returns or patient care services. Whilst an £84m saving now, and £106m of savings over 5 years, is small compared to the financial challenges facing the NHS, the tax would bring in increasing revenues over time. This would be due to profitability improving (in line with the financial model) and tax rates falling over time making the gap between the estimated tax take at 30% and the actual tax paid widen.

Moreover, this windfall tax could be applied across other sectors outside health. According to Treasury figures 450 of the 589 PFI schemes (across all sectors excluding health) reached financial close before the fall in corporation tax rates from 30%.

Two additional considerations concerning the accounting details of the calculations in this blog are considered in a downloadable appendix

Support Our Work

CHPI is the only truly independent health think-tank dedicated to the founding principles of the NHS. To continue our work keeping the public interest at the centre of health and social care policy, we need your help.

Please support CHPI so we can continue to impact the health policy debate.